Phoenix-Area Housing Market Begins to Rebound — But Recovery Is Uneven Across Cities

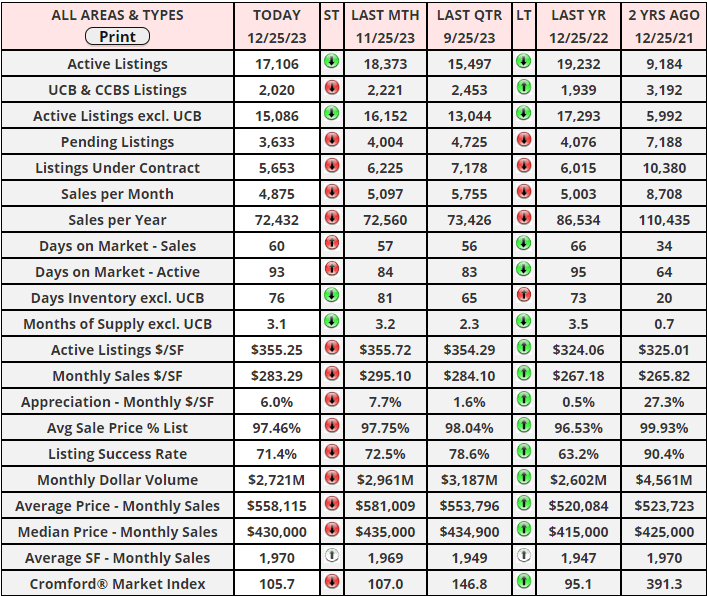

The real estate market, as reflected in the Cromford® Market Index (CMI), presents a dynamic landscape across various cities. Over the last month, an average decline of 3.0% in the CMI for 17 major cities has been observed, marking a significant shift from the steeper 6.7% decline witnessed just a week prior. While this indicates a notable improvement, it's important to acknowledge that the average CMI remains slightly lower than it was a month ago. However, in a promising turn of events, the average CMI has not only ceased its downward trajectory in the past week but has also exhibited a 1% rise. This development suggests that the market is now entering a recovery trend, a positive sign for stakeholders.

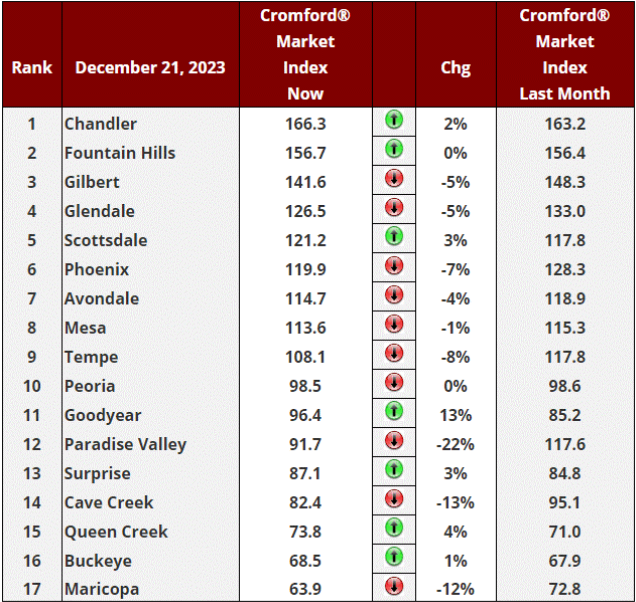

Examining the performance of individual cities reveals varied trends within this broader recovery. Notably, Scottsdale, Goodyear, and Chandler have shown positive movements over the past month. They have now been joined by Fountain Hills, Surprise, Queen Creek, and Buckeye, all moving upwards on the index. This upward movement in these cities is a hopeful indication of market stabilization and growth. In contrast, Paradise Valley, Cave Creek, and Maricopa are still grappling with double-digit percentage declines over the last month. This disparity highlights the uneven nature of the real estate recovery across different locales.

The current state of the market can be categorized by the type of market prevailing in these cities. Out of the 17 cities analyzed, 8 are still classified as seller's markets, indicative of a scenario where demand outstrips supply, giving sellers an advantage in pricing and negotiations. On the other hand, there are 4 cities where the market conditions are balanced, suggesting a more equitable environment for both buyers and sellers. Meanwhile, 5 cities are categorized as buyer's markets, where buyers have the upper hand due to a surplus of available properties. This distribution underscores the diverse market conditions prevailing across different cities.

One city, in particular, stands out for its ongoing struggles: Maricopa. It is identified as the weakest market among the 17 cities under consideration. Maricopa's market has been notably slow in showing signs of recovery or stabilization, lagging behind its counterparts. This continued downturn in Maricopa serves as a reminder of the challenges still facing certain areas, even as other parts of the region begin to experience recovery. The varied pace and nature of recovery across these cities highlight the complexity of the real estate market and the need for nuanced, location-specific strategies to navigate it effectively.

We will still need to monitor rates, if they continue to drop will only further this trend in buying demand. As buyers slowly start entering back into the market seeing that supply is stabilizing and no signs of a crash imminent.

“Christmas Day is in our grasp, as long as we have hands to clasp! Christmas Day will always be, just as long, as we have we! Welcome Christmas while we stand, heart to heart, and hand in hand!”

–Dr. Seuss

Examining the performance of individual cities reveals varied trends within this broader recovery. Notably, Scottsdale, Goodyear, and Chandler have shown positive movements over the past month. They have now been joined by Fountain Hills, Surprise, Queen Creek, and Buckeye, all moving upwards on the index. This upward movement in these cities is a hopeful indication of market stabilization and growth. In contrast, Paradise Valley, Cave Creek, and Maricopa are still grappling with double-digit percentage declines over the last month. This disparity highlights the uneven nature of the real estate recovery across different locales.

The current state of the market can be categorized by the type of market prevailing in these cities. Out of the 17 cities analyzed, 8 are still classified as seller's markets, indicative of a scenario where demand outstrips supply, giving sellers an advantage in pricing and negotiations. On the other hand, there are 4 cities where the market conditions are balanced, suggesting a more equitable environment for both buyers and sellers. Meanwhile, 5 cities are categorized as buyer's markets, where buyers have the upper hand due to a surplus of available properties. This distribution underscores the diverse market conditions prevailing across different cities.

One city, in particular, stands out for its ongoing struggles: Maricopa. It is identified as the weakest market among the 17 cities under consideration. Maricopa's market has been notably slow in showing signs of recovery or stabilization, lagging behind its counterparts. This continued downturn in Maricopa serves as a reminder of the challenges still facing certain areas, even as other parts of the region begin to experience recovery. The varied pace and nature of recovery across these cities highlight the complexity of the real estate market and the need for nuanced, location-specific strategies to navigate it effectively.

We will still need to monitor rates, if they continue to drop will only further this trend in buying demand. As buyers slowly start entering back into the market seeing that supply is stabilizing and no signs of a crash imminent.

“Christmas Day is in our grasp, as long as we have hands to clasp! Christmas Day will always be, just as long, as we have we! Welcome Christmas while we stand, heart to heart, and hand in hand!”

–Dr. Seuss

Have a great week everyone!

Recent Posts

December Market Update Shows Continued Strength for Phoenix Area Sellers

Phoenix Sellers See Strong Holiday Boost as Market Momentum Builds

Condo and Townhome Sales Hit Lowest Level Since 2009

Phoenix Area Sellers Gain Momentum as CMI Jumps to +8.6%

Record Phoenix Home Prices: Why Price Per Square Foot Just Spiked Past $318

Are FHA Loans the New Sub-Prime? Not So Fast.

How Builders Are Winning the Market with Mortgage Rate Buydowns

Phoenix Housing Market Snapshot: Buyer Momentum Slows Across Valley

Why Arcadia Remains Phoenix’s Most Desired Neighborhood in 2025

Modern Home Design Trends 2025 | Phoenix Renovation and Remodel Ideas

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "