Phoenix Housing Market Tips Further Toward Buyers as Seller Leverage Slips

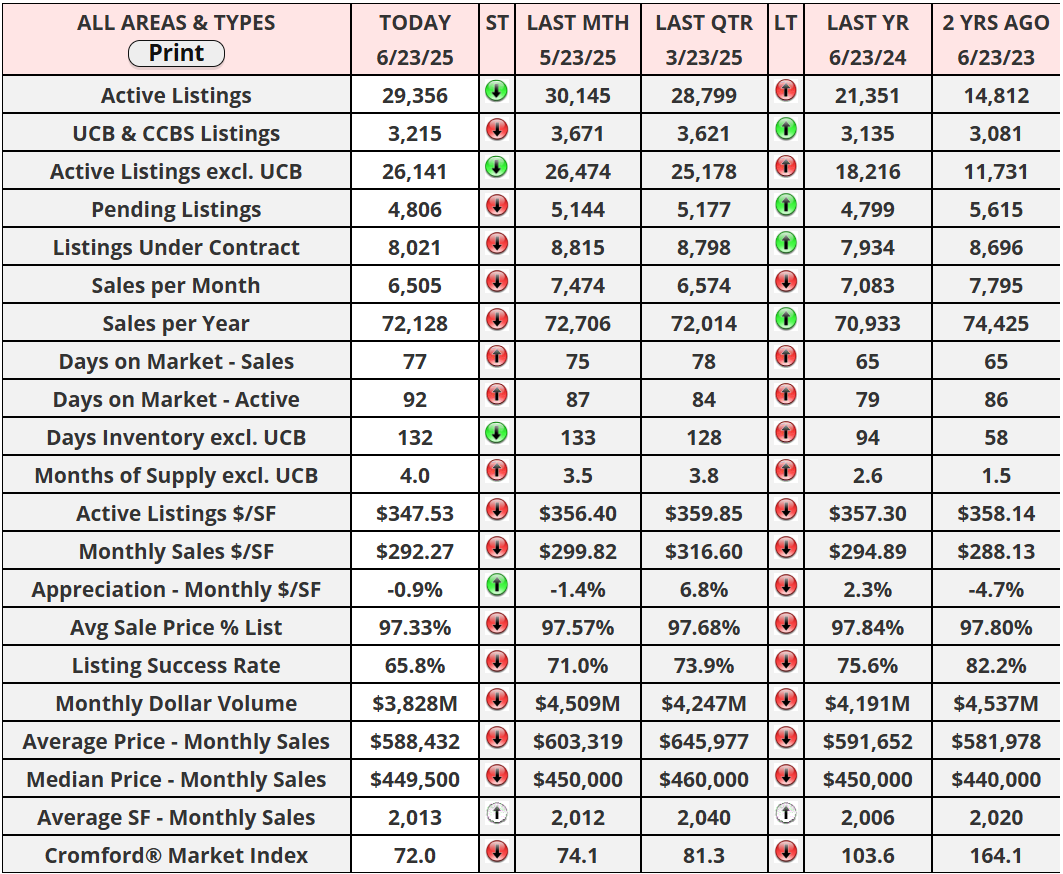

The Phoenix-area housing market continues to slide in favor of buyers, reversing a short-lived trend of slowing declines. The average change in the Cromford Market Index (CMI) this week was 2.7 percent, slightly more negative than last week’s 2.5 percent. This marks a departure from the previous three weeks, which had shown gradual improvement. That said, the shift is modest and doesn’t necessarily indicate a new long-term trend. Still, the latest data shows just one city improving for sellers: Paradise Valley, up 10 percent. But PV’s impact is limited due to its small unit count, even though it holds a higher dollar volume. Meanwhile, Phoenix and Buckeye, with 7 percent drops, were the biggest drags, particularly Phoenix, which accounts for about a quarter of Central Arizona’s housing market.

Currently, only three cities qualify as seller’s markets and two of those are hanging on by a thread. Six cities are now balanced, while eight have shifted into buyer’s market territory. Notable moves include Tempe falling from balanced to buyer’s market and Chandler downgrading from seller’s to balanced. This market-wide transition is a clear indication that sellers are steadily losing leverage while buyers gain more negotiating power.

This environment presents a golden opportunity for buyers. There’s plenty of inventory to choose from, and many sellers are highly motivated to strike a deal. This isn’t limited to resale homes, as new construction builders are feeling the pressure too, and many are offering substantial incentives like rate buydowns to get buyers to commit. It’s the most favorable buyer’s landscape we’ve seen since March 2009, giving today’s home shoppers a rare advantage not seen in over a decade.

Paradise Valley’s strong performance is largely being fueled by bullish stock and crypto markets, but the broader real estate market remains constrained by challenges in the bond market. A meaningful drop in mortgage rates is unlikely unless demand for 10-year treasury bills surges, and that isn’t happening yet, especially with the US dollar weakening. Foreign investment isn’t expected to rescue the market either. While buyers in the UK, Switzerland, and Canada do benefit from currency exchange discounts compared to January 2025, they represent a very small portion of the Arizona market. Any real demand rebound will have to come from domestic buyers.

"Leap, and the net will appear."

-John Burroughs

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "