Maricopa County Sees Slight Uptick in Closings as Buyers Watch Falling Rates

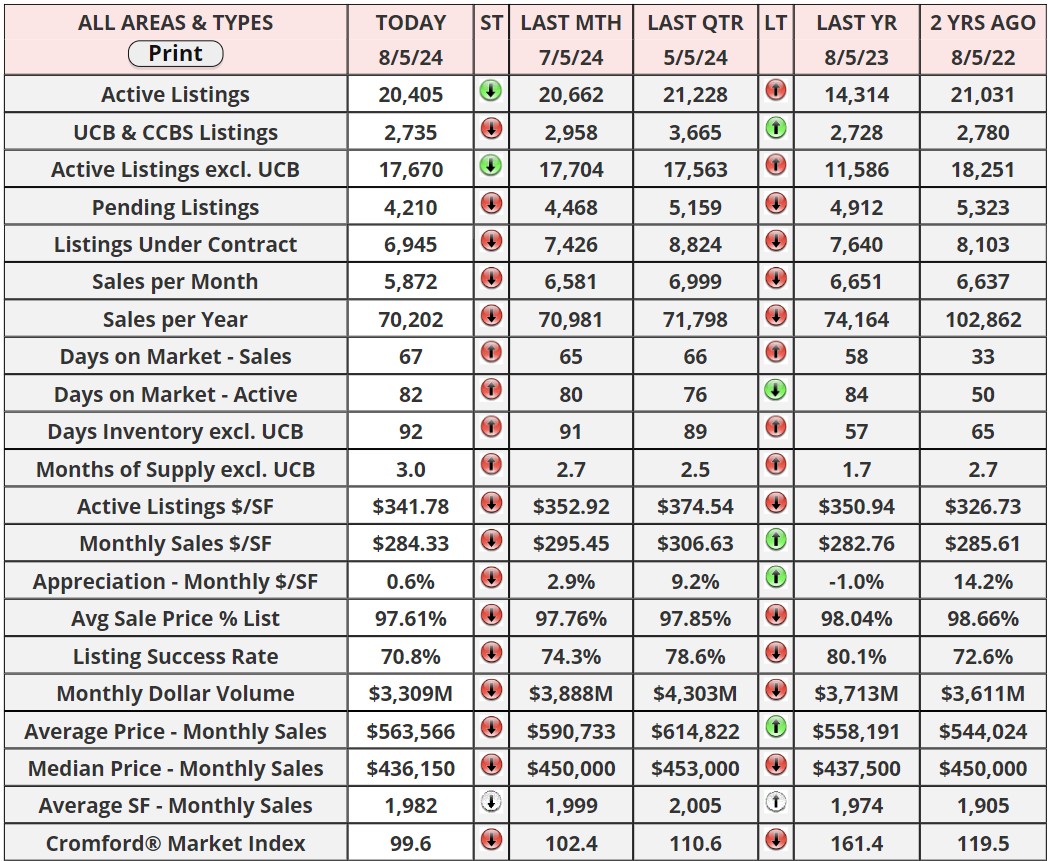

In July 2024, Maricopa County recorded a total of 6,360 closed real estate transactions, reflecting a 4.6% increase from the previous year's figure of 6,081 in July 2023, but a slight 4.1% decrease from June's numbers. Of these, 1,378 were newly constructed homes, marking a modest growth of 1.9% compared to 1,352 in the same month the previous year, though this segment saw a significant 13% drop from June. The resale market was more dynamic, with 4,982 transactions completed, up 5.4% from 4,729 in July 2023 and only a minimal 1.3% decrease from the previous month. This activity occurred over 22 working days, one more than in July 2023, offering a partial explanation for the increase in closings.

The pricing dynamics in the market also painted a mixed picture. The overall median sales price for July stood at $467,545, a slight increase of 0.5% from July 2023 but a decrease of 1.6% from the previous month. Resale homes had a median price of $450,000, up 1.1% year-over-year but down by 3.2% from June, indicating some softening in prices. In contrast, new homes had a median price of $506,240, which was down significantly by 5.1% from the previous year, although it showed a small recovery of 0.5% from June.

The market share of new homes decreased slightly to 21.7% from 22.2% a year earlier, suggesting a shift in buyer preference or possibly a response to pricing dynamics. Resale prices have notably struggled, remaining well below the peak of $486,000 reached in May 2022, prior to the liquidation sales initiated by iBuyers. This decline underscores the broader trend of weakening prices in the resale segment, contrasted with the overall median sales price increase of only 0.5%—a figure that falls below the inflation rate, indicating that, in real terms, homes have become more affordable compared to last year.

Despite the nominal increase in median household incomes over the past year, the housing market in Maricopa County has seen improved affordability without a corresponding increase in demand. This suggests potential buyers may be anticipating further reductions in mortgage rates, influenced by recent statements from the Federal Reserve indicating possible adjustments. The observed trends cover both single-family homes and townhouse/condo residences, reflecting a comprehensive view of the county’s housing market dynamics during this period.

If you are a buyer that has been waiting, KEEP EYES ON RATES! As of today, the 30-year has dropped significantly to 6.34%. Have to keep eye on this to see if there is any bounce back or if rates possibly keep falling with all this talk of markets crashing globally as investors continue to flock to the certainty of bonds. If so might be an opportune time to take advantage of the rate reduction and weary sellers who are not being educated properly by subpar agents on the market's current market conditions!

“Failure is simply the opportunity to begin again, this time more intelligently.”

—Henry Ford

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "