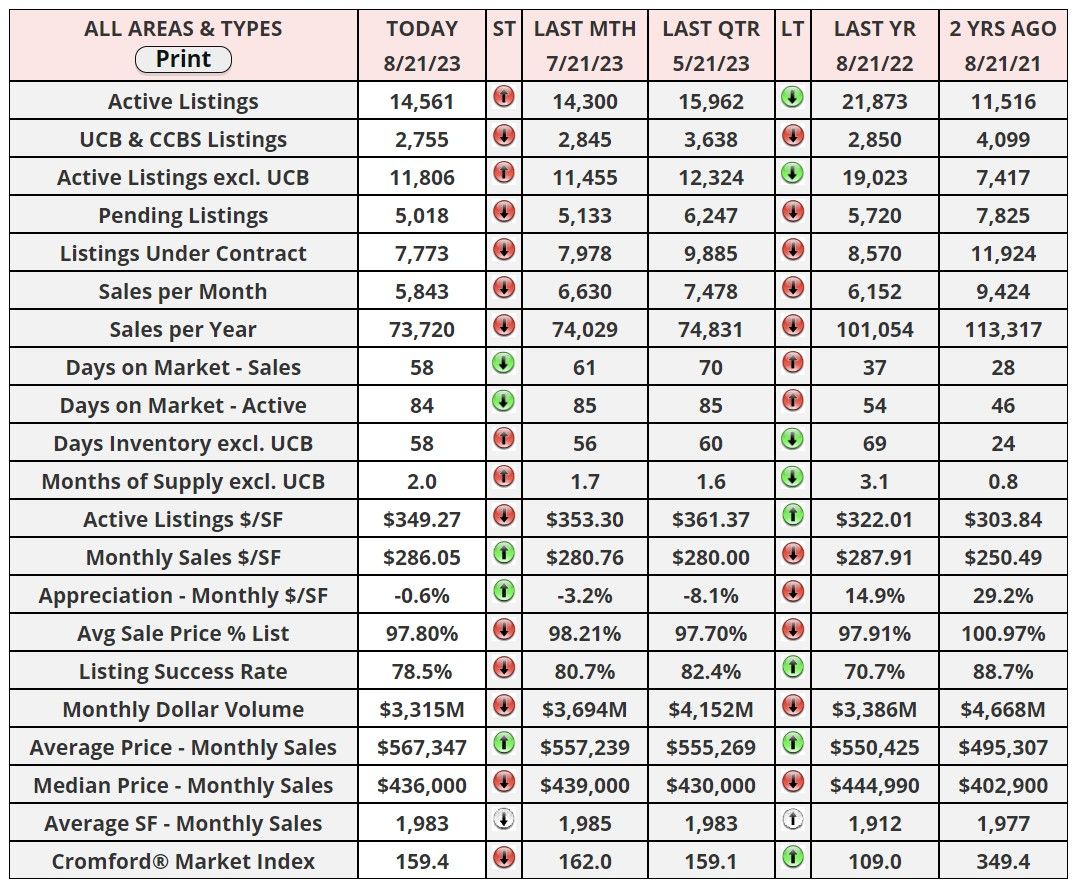

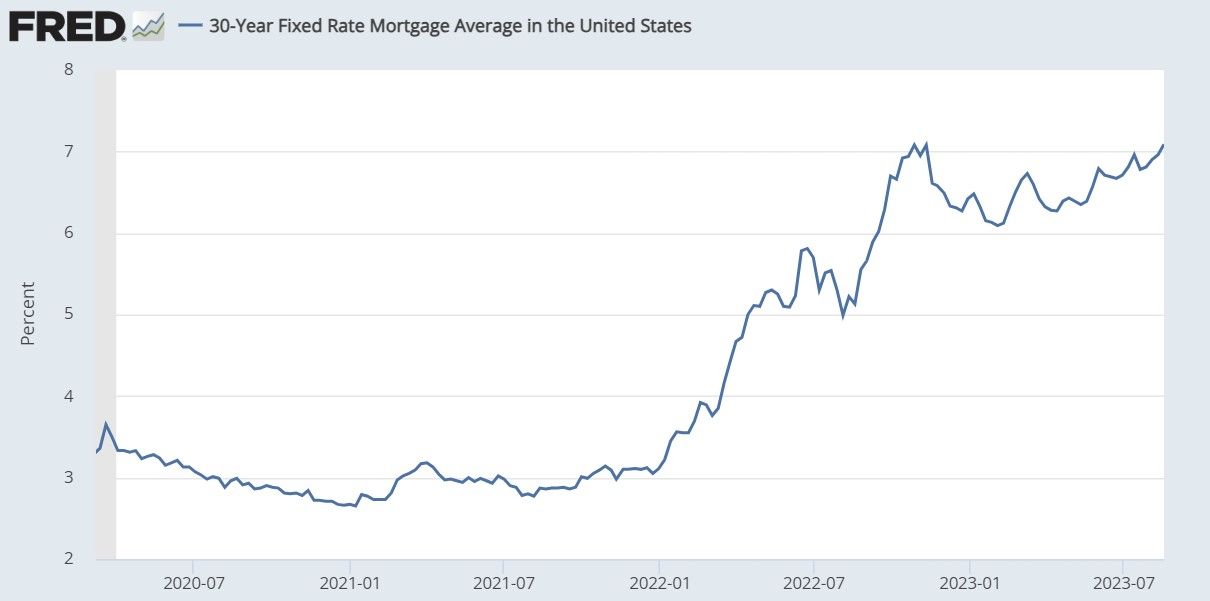

Mortgage Rates Hit 7.48% — Highest Since 2000 as Housing Market Faces Standoff

Mortgage rates experienced a significant surge on Monday, reaching 7.48% on the 30-year fixed mortgage, the highest since November 2000, due to rising bond yields. These increases in bond yields are driven by investors' worries about prolonged high interest rates and inflation. Matthew Graham of Mortgage News Daily highlighted that investors haven't observed the anticipated economic deterioration, which the Federal Reserve is also waiting for before contemplating any policy shifts. Consequently, long-term rates like the 10-year Treasury yields and mortgages are affected negatively.

Additionally, this uptick in rates comes as another blow to potential homebuyers, who are already grappling with inflated home prices due to the Covid pandemic. While 2020 saw record-low rates, sparking a massive demand in homes and driving up prices by over 40% by the summer of 2022, the current rate environment is drastically different. Many homeowners, who locked in rates around or even below 3%, are now hesitant to sell and relocate, fearing the financial repercussions of the present high rates. This phenomenon is termed as "golden handcuffs" among potential sellers.

The implications for buyers are equally significant. Comparing the present situation to just a year prior, a person looking to buy a $400,000 home, putting down 20% on a 30-year fixed loan, would now be paying approximately $420 more every month. As a result, many borrowers are turning to adjustable-rate loans, which provide lower interest rates for shorter durations. For instance, last week, the average rate for a 5-year ARM stood at 6.2%, and its application share increased to 7%, a stark contrast to the less than 2% in 2020 when the 30-year fixed rates were at record lows.

In response to these rising mortgage rates, homebuilders are employing strategies such as buying down these rates for different terms or reducing home prices. Although they had limited these incentives earlier this year due to increased demand and decreasing rates, they've recently reintroduced them. However, homebuilder sentiment took a hit in August, primarily attributing the decline to these rising interest rates.

This situation is very unique since buyer demand has dropped, pricing however is still remaining elevated due to our low inventory. It is a self-inflicting feedback loop. Sellers don't want to sell to buy high, buyers don't want to buy high and low inventory, rates are too high to incentivize buying, and the cycle continues. We should be keeping an eye on the unemployment charts month over month because one canary in the coal mine will be just that, once sellers are forced to sell into a high-interest rate environment, then things will get interesting.

“We cannot solve problems with the kind of thinking we employed when we came up with them.”

— Albert Einstein

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "