August Inflation Rises to 3.7% as Phoenix Watches Fed and Market Impact Closely

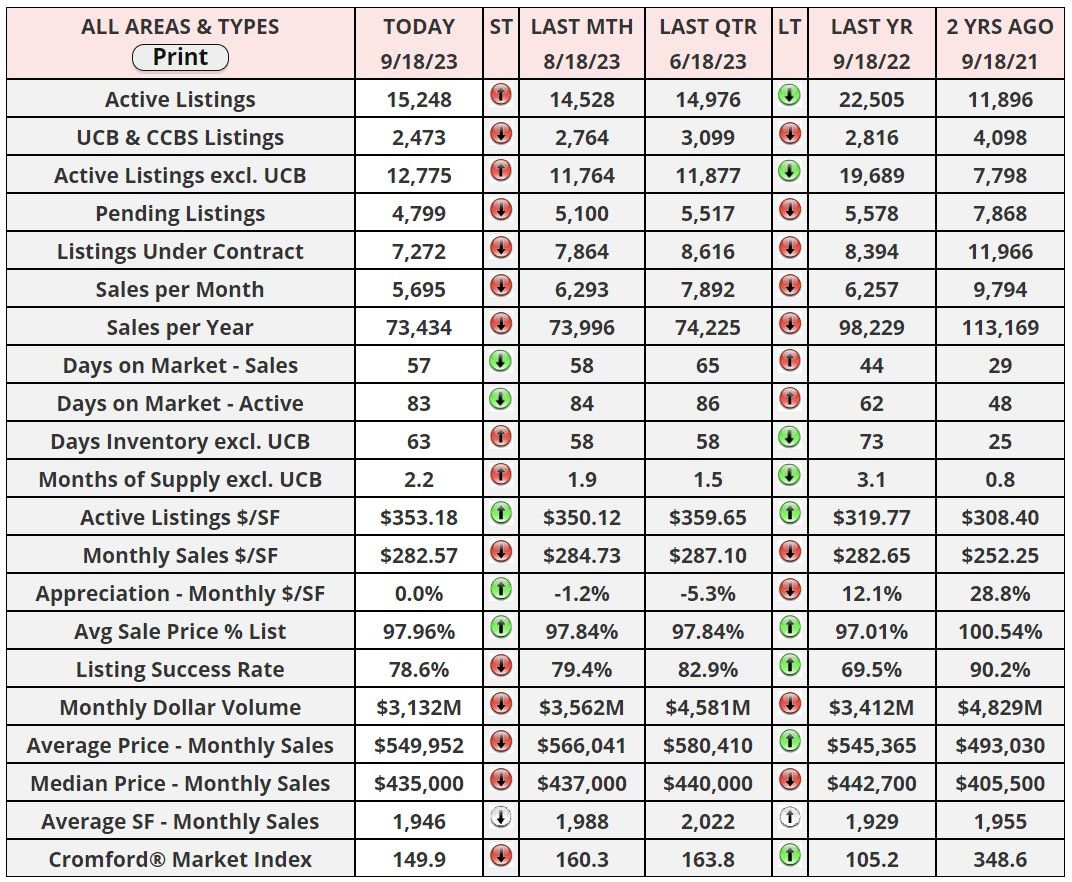

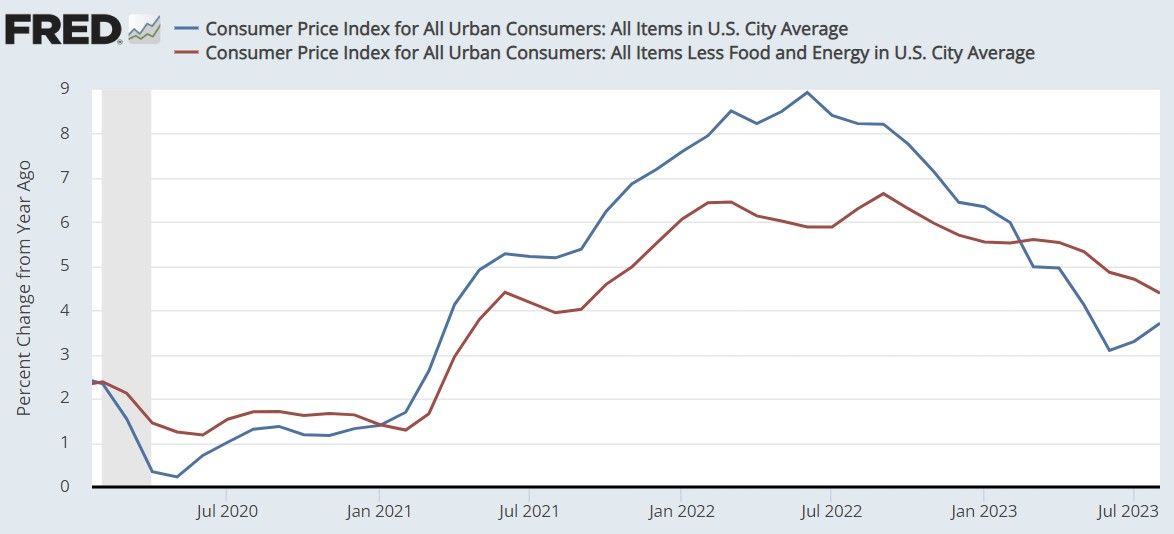

August brought with it a range of economic data that can provide us with insights into the broader market, particularly in regions like Phoenix. The Consumer Price Index (CPI) of August revealed an inflation increase of 0.6%, aligning closely with most estimates. This sees the annual CPI rising from 3.2% to 3.7% for the past month. Remarkably, this is still near the lowest it's been in over two years. The Core CPI, which omits the often unpredictable food and energy prices, rose by 0.3% in contrast to its annual figure which dropped from 4.7% to 4.3%. Phoenix, with our volatile housing market, closely watches these numbers, as they can significantly influence real estate trends.

The breakdown of these figures demonstrates how diverse factors can impact inflation. For instance, the prominent surge in energy and gasoline prices accounted for a large portion of the month's increase. Conversely, steady food and shelter costs, coupled with a decrease in used car prices, provided a counterbalance. Interestingly, for regions like Phoenix with a demand for housing compared to others, any prolonged impact from events like the United Auto Workers strike can influence the supply of new cars, potentially causing a surge in used car prices.

Further, on the wholesale front, the Producer Price Index (PPI) for August witnessed a rise of 0.7%, surpassing expectations. This signifies that, annually, the PPI leaped from 0.8% to 1.6%. When isolating the volatile costs of food and energy, the Core PPI saw an increase of 0.2%, while its year-over-year figure slid from 2.4% to 2.2%. A significant portion of this inflation can be attributed to escalating energy prices. For cities like ours, where the housing market is intertwined with broader economic trends, understanding these inflationary movements is crucial.

As inflation remains a central concern, the Federal Reserve has been proactive. The benchmark Fed Funds Rate, which represents the overnight borrowing rate for banks, has been raised in an effort to temper the economy and mitigate inflation. Following their most recent increase in July, the rate reached its highest in 22 years. But with the progress seen in controlling inflation, there is speculation that the Fed may consider pausing further hikes. Comments from influential figures like New York President John Williams and Dallas Fed President Lorie Logan hint at such a direction. As the Fed wraps up its two-day meeting this Wednesday, all eyes will be on them, awaiting their next move.

"Keep your face always toward the sunshine, and shadows will fall behind you."

— Walt Whitman

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "