Banning Institutional Home Buyers Would Change Little in Today’s Housing Market

The proposal to ban institutional investors from purchasing homes has gained renewed attention, but turning this idea into law would be far more complex than announcing it. Defining what qualifies as an institutional investor is legally tricky. Large Wall Street firms are easy to identify, but many small investors operate through LLCs as well. These so called mom and pop investors collectively own far more rental homes than large institutions and are a critical source of rental housing. Any law that accidentally sweeps them in would risk shrinking rental supply and creating new affordability problems rather than solving them.

Even with a narrow definition, enforcement would be difficult. If restrictions applied only to firms owning more than a certain number of homes, those companies could simply split into multiple smaller entities and bypass the rule. Lawmakers would also need to decide what types of properties are covered. Questions around land purchases, build-to-rent communities, and multi-family housing would all need clear answers. Policing violations and assigning penalties would add further cost and complexity. From a policy standpoint, a financial deterrent such as higher targeted taxes would likely be simpler and more effective than an outright ban.

There does appear to be bipartisan political support for limiting institutional home buying. Senator Elizabeth Warren has advocated for such restrictions for years and has publicly supported similar proposals from President Trump. However, the biggest flaw in the idea is timing. Institutional investors are no longer a meaningful force in today’s housing market. The behavior lawmakers want to stop has already faded on its own due to changing market conditions and higher interest rates.

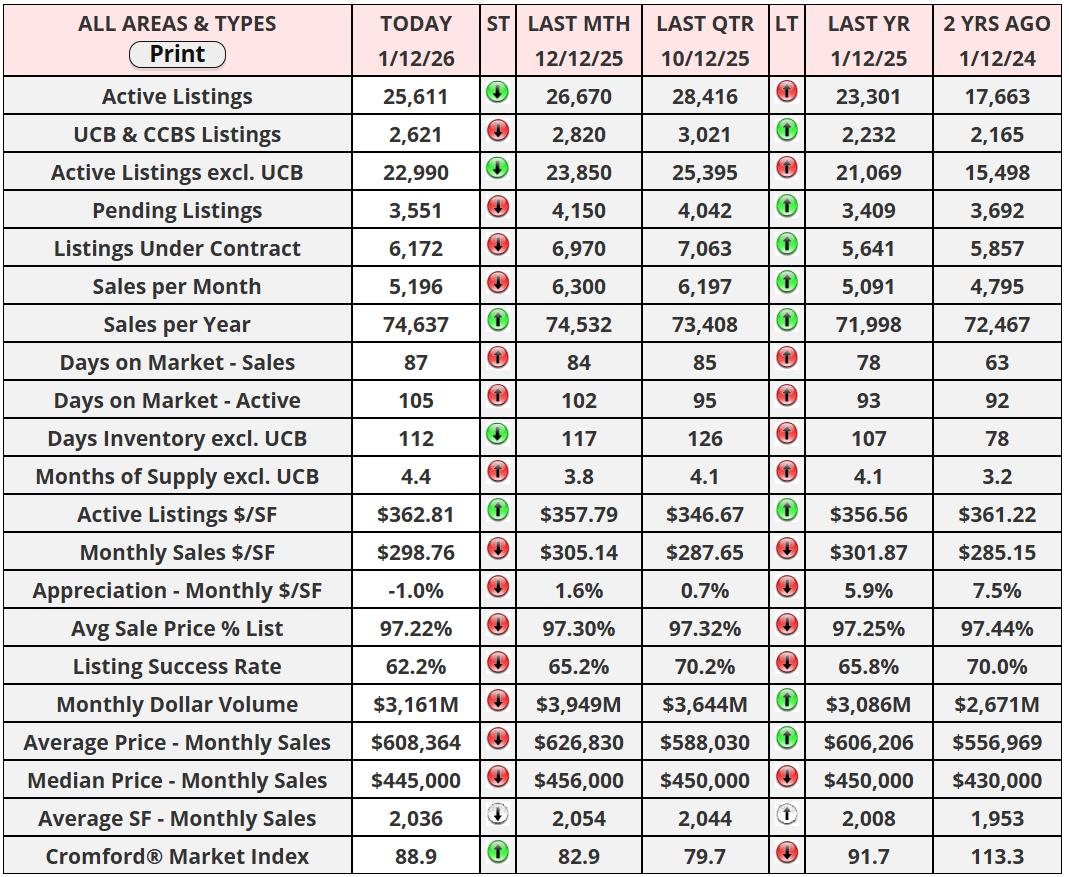

The data makes this clear. In Maricopa County, institutional investors bought just 82 homes in 2025, representing roughly 0.1 percent of all transactions. That compares with 493 purchases in 2024, 1,378 in 2023, over 6,000 in 2022, and more than 8,500 in 2021. Institutional buying peaked in August 2021, when it accounted for about 10 percent of the market, one hundred times its current share. In effect, the horse left the stable years ago. Implementing a costly and complex ban today would have almost no real-world impact. The only action that would materially change the market would be forcing institutions to sell homes they already own, and that raises an entirely different set of legal and economic consequences.

“The two most important days in your life are the day you are born... and the day you find out why.”

-Mark Twain

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "