Are FHA Loans the New Sub-Prime? Not So Fast.

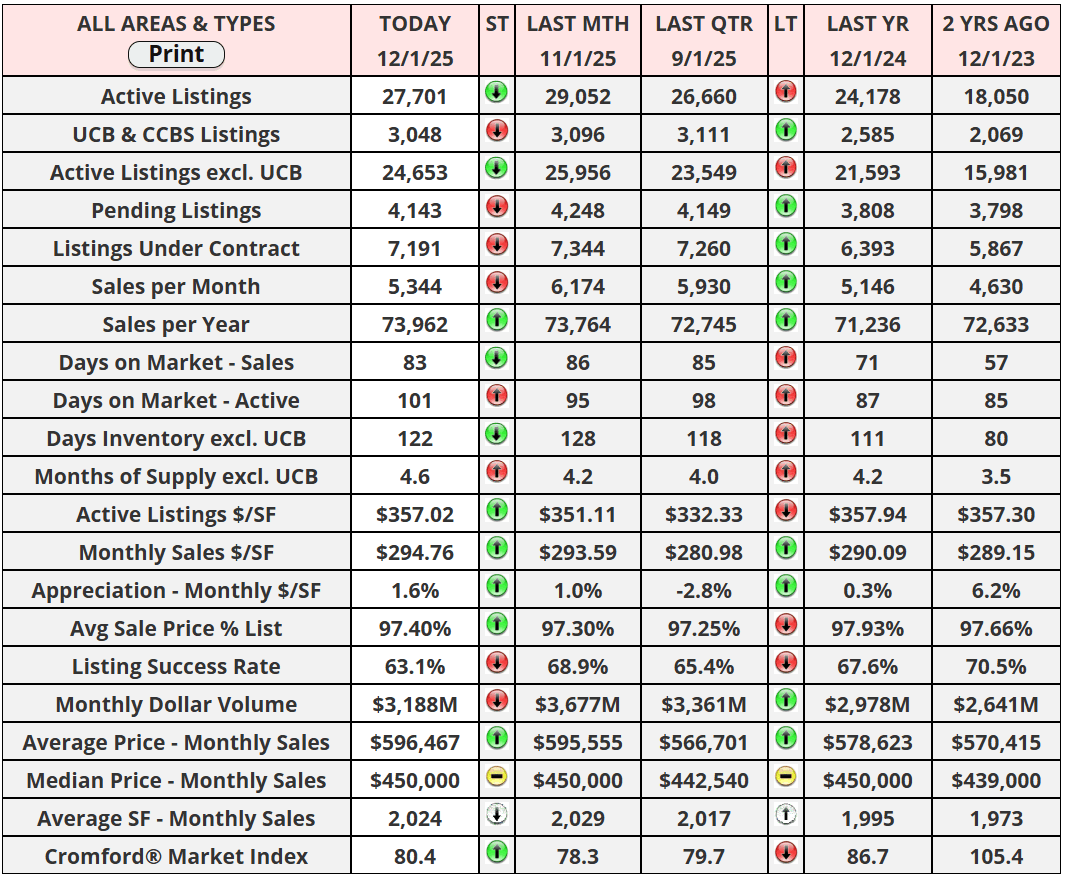

Some recent claims circulating online suggest that FHA loans are “the new subprime,” warning of high default risk and market instability. While FHA loans do carry higher delinquency rates than conventional loans, that’s by design; they’re meant to help riskier borrowers, such as first-time buyers, enter the housing market. FHA’s share of the market has indeed risen in recent years, now making up about 16–20% of Phoenix-area transactions, but that’s still well within historical norms. Back in 2015–2016, FHA loans held 20–25% of the market, even higher than today. So while the exposure is real, it’s not out of line with what we’ve seen before.

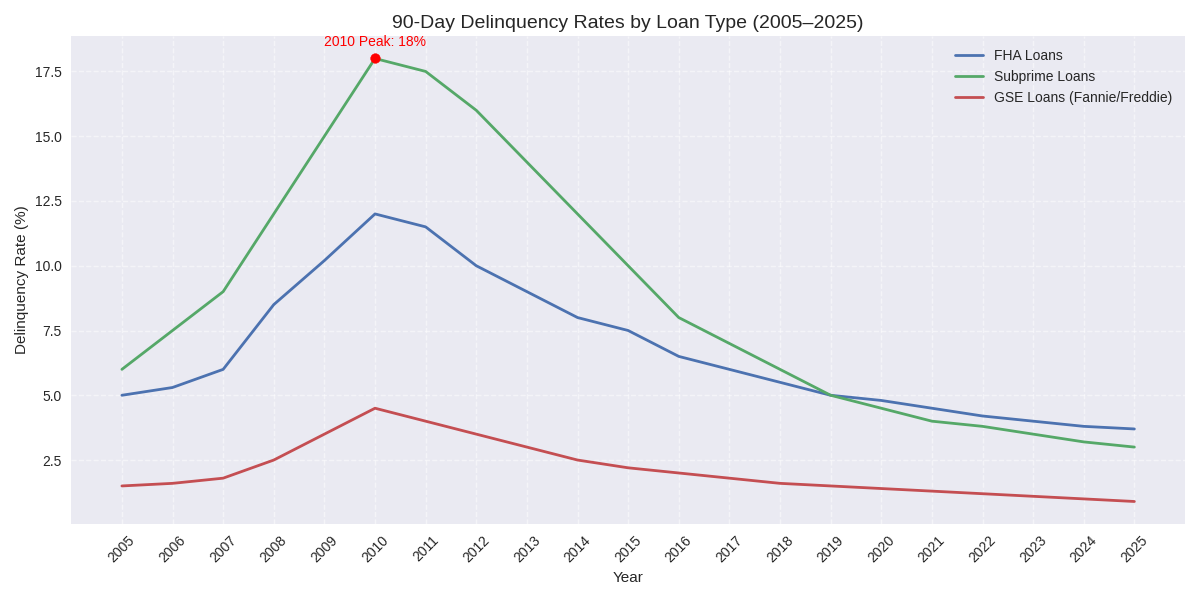

Comparisons to the subprime crisis of 2004–2010 are misleading. At the peak of that era, more than 30% of subprime loans were 30+ days delinquent. Today, both FHA and subprime loans sit below 5% delinquency, one of the lowest levels in 20 years. Moreover, 90-day delinquency, a better indicator of true loan distress, remains far below red-flag territory. While some investors use FHA products creatively, like house-hacking multi-unit homes, the impact in Arizona is negligible due to the limited number of multi-family properties. Allegations of fraud or widespread misuse of FHA loans in the state are not supported by data, which remains transparent and traceable via public filings.

Investor misuse is always possible, but it's rare in Arizona thanks to public deed recording and affidavit requirements. Buyers must legally affirm their intent to occupy, reducing the chance for deception. Fraud schemes like straw-buyer setups or falsified applications exist in theory but lack scale locally. FHA's structure does open doors for occasional abuse, but the safeguards in place here keep it contained. What’s more important than fear-based speculation is sticking to real indicators like 90-day delinquency rates. If they begin to spike over 7%, that’s a red flag. Until then, the system is functioning as designed.

The Cromford® Report urges calm, not panic. FHA loans aren't destabilizing the market; they’re supporting it. Wild predictions may get headlines, but they aren’t backed by real numbers. As it stands, market conditions remain far more stable than alarmists suggest. Monitoring data closely is critical, but exaggerating risk does more harm than good.

"If you fell down yesterday, stand up today."

-H. G. Wells

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "