Phoenix Buyer Demand Hits 17-Year Low: What’s Holding the Market Back?

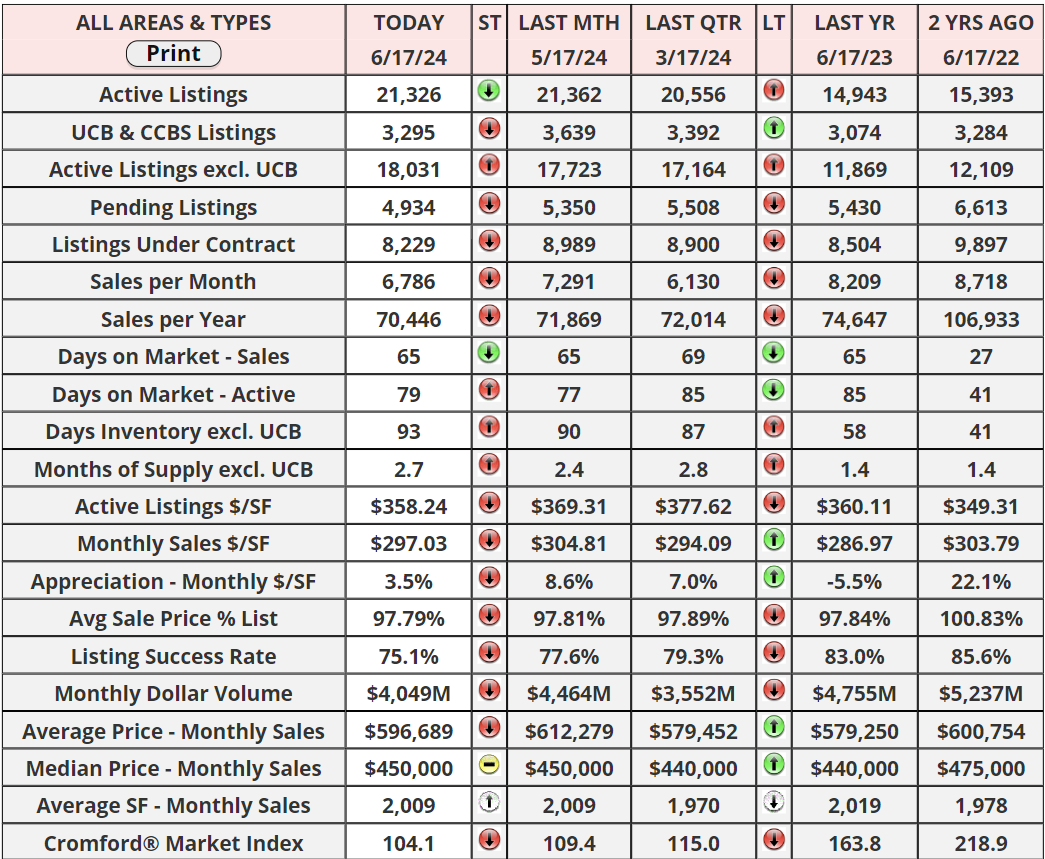

In the current real estate market, week 23 of 2024 has seen a startlingly low number of homes under contract, with only 8,238 listings—a number that hasn't been this dismal since 2007. The data highlights a concerning trend, as not once this year has the market managed to surpass the already low totals of 2023. This stagnation points to a significant decrease in buyer interest and market activity, reflecting broader economic apprehensions and a possible downturn in buyer confidence.

Reflecting on 2007, it's evident that it was a notably challenging year for the real estate market, primarily due to widespread anticipation of a housing price collapse. This resulted in a complete market stall, setting a precedent for poor market conditions. However, while 2024 mirrors some of these issues with low buyer enthusiasm, the current circumstances differ as there isn't an imminent expectation of a market crash. Nevertheless, the low number of contracts is an indicator of continuing buyer reticence towards investing in resale homes.

To offer some perspective on just how low current engagement is, during week 23 of 2011, there were over 21,000 homes under contract—more than double the current figures. This stark contrast not only underscores the sluggishness of today's market but also accentuates the need for significant changes to rejuvenate buyer interest and market dynamics.

Looking ahead, there is potential for improvement if the conditions align favorably. Particularly, a reduction in the 30-year fixed mortgage rate to well below 7% could stimulate the market. It is advisable for stakeholders to monitor the market indicators closely over the next few months, especially the movements of the turquoise line relative to the purple line in market trend graphs. This observation could provide early signs of whether we can expect a recovery or if the market will continue to struggle.

Rates will continue to be a huge steering factor in buyer demand. I am not expecting any surges only possible lowering as we head into the election this year. As some global tensions also seem to be rising a bit, will be smart to keep an eye on treasury yields heading into the election as well since mortgage rates are mostly based on the 10-year.

“You don’t have to be great to start, but you have to start to be great.”

– Zig Ziglar

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "