Cromford Index Slide Slows as Mortgage Rates Dip Below 7%

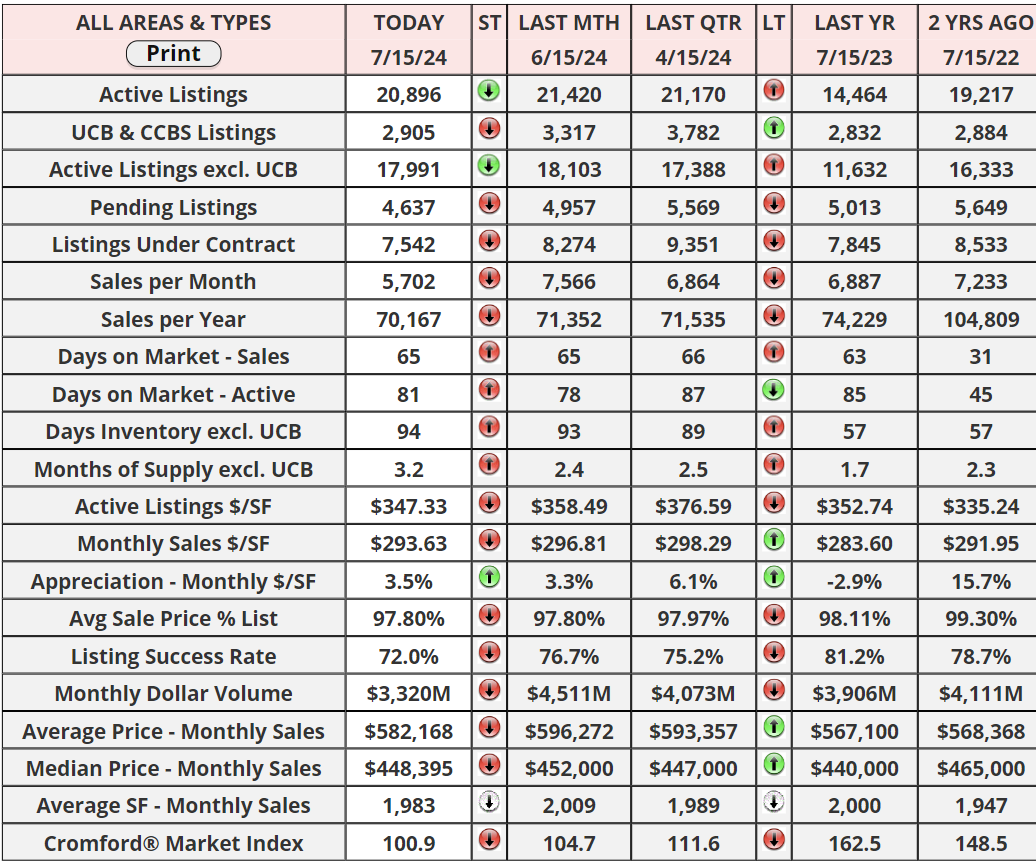

Over the past month, the average change in the Cromford Market Index (CMI) has been a notable -7.2%, a more significant decline than the -6.9% observed the previous week. However, there is a silver lining as the rate of decline appears to be slowing. This week’s -0.3% change is an improvement compared to the -0.8% measured last week. If this trend continues, we could potentially see a reduction in the monthly deterioration soon.

In the past two weeks, only three cities have shown an increase in their CMI, while fourteen cities have experienced a decline. The three cities with improving CMI are the same as last week, with Avondale standing out for its significant percentage increase. This limited improvement contrasts with the broader trend of declining market indices across most cities.

A substantial shift in favor of buyers has been observed in several cities, including Tempe, Gilbert, Fountain Hills, Paradise Valley, Goodyear, Cave Creek, Glendale, and Chandler. Despite this shift, nine out of seventeen cities remain strong seller's markets, with indices over 110. Two cities are balanced, and six have transitioned into buyer's markets. Notably, only three cities maintain a CMI above 140.

Although there has been little change since last week, the market is approaching a balance without clear signs of a widespread shift towards a buyer's market. The recent release of benign Consumer Price Index (CPI) data has had a small downward impact on mortgage rates but has significantly boosted the share prices of home builders, with KB Home seeing a rise of over 10% in anticipation of improved market conditions if the Federal Reserve lowers rates. Overall supply seems to be leveling off, halting the upward trend observed since the beginning of the year. Should interest rates fall, any resulting improvement in demand could potentially reverse the CMI's direction. However, this remains speculative and unconfirmed at this stage. Further developments will be closely monitored and reported.

Mortgage rates will continue to be the steer to market demand. I have noticed the last week we have been below the 7% average and have been trending down which might give some more push of buyers into the market in the next month or two if it continues to drop!

“The best way out is always through.”

―Robert Frost

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "