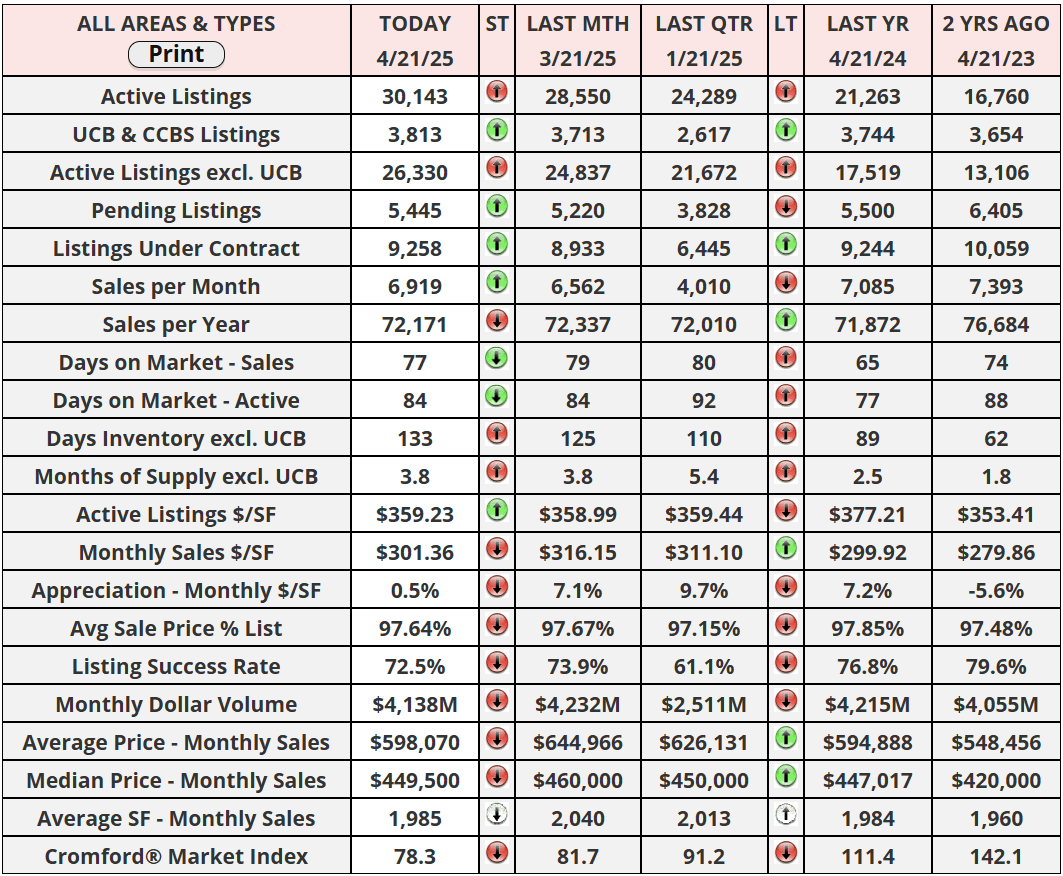

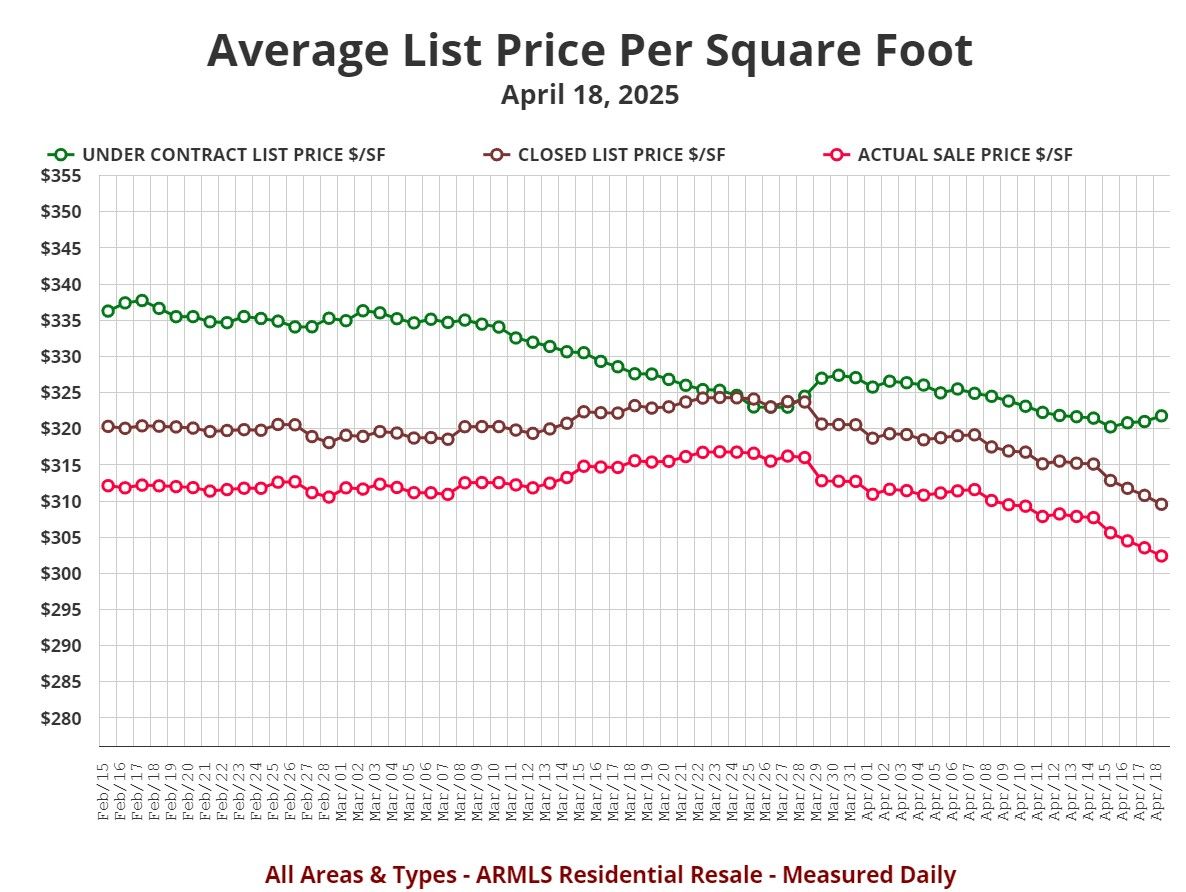

Phoenix Home Prices Drop Sharply: Under-Contract Price per Sq Ft Falls 4.3% in 3 Weeks

The data is starting to show a notable decline in home prices, with the average price per square foot for listings under contract, represented by the green line, falling from $350 in late December to $322 today. This measure dipped to $335 before dropping again about five weeks ago, signaling a consistent downward trend. Since this metric reflects properties currently under contract, it serves as a leading indicator for where final closing prices are headed in the near future.

While under-contract prices have been softening, closed price metrics have only recently started to shift. The brown line, which represents the average price per square foot of closed listings, remained steady through Q1 but began trending downward at the end of March. Meanwhile, the red line tracks the actual sold price per square foot over a rolling monthly period. For example, data reported for April 18 includes all closings from March 18 through April 17, allowing for up-to-date insight into evolving trends without relying strictly on calendar months.

Currently, homes are selling for about 97.7% of their list price, and this figure has shown minimal daily fluctuation. This consistency is largely due to buyer psychology; many buyers still anchor to the list price, even if some negotiate harder. However, this percentage reflects the final list price, not the original one, meaning price reductions are likely baked in. While last year this percentage was slightly higher at 97.9%, seller concessions have increased notably in 2025 compared to 2024, a detail not captured in the list-to-sale percentage but evident in MLS records.

Perhaps most concerning is the rapid decline in the monthly average sale price per square foot from $316.01 on March 28 to $302.40 by April 18. That’s a 4.3% drop in just three weeks, an unusually steep decline. While the green line has flattened in recent days, its earlier dip below the brown line on March 25 was a strong signal of coming weakness. Since closed prices reflect deals signed weeks prior, the green line will continue to serve as our primary warning sign. Where it moves next will be crucial in determining how the broader market reacts in the weeks ahead.

"You play the hand you're dealt. I think the game's worthwhile."

-Christopher Reeve

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "