Phoenix Housing Market Shifts Further Toward Buyers as Supply Hits 13-Year High in May 2025

The latest data continues to show the Greater Phoenix housing market shifting further in favor of buyers, and that momentum has begun to accelerate. Over the past month, 13 cities have deteriorated for sellers while only four have improved. Among the improving markets, Avondale stands out with a significant 12% increase, followed by modest gains of 4% in Glendale and Maricopa. Surprise showed only a slight uptick of 0.3%, offering minimal relief to sellers there. Meanwhile, Tempe, Goodyear, and Queen Creek saw the most substantial moves benefiting buyers.

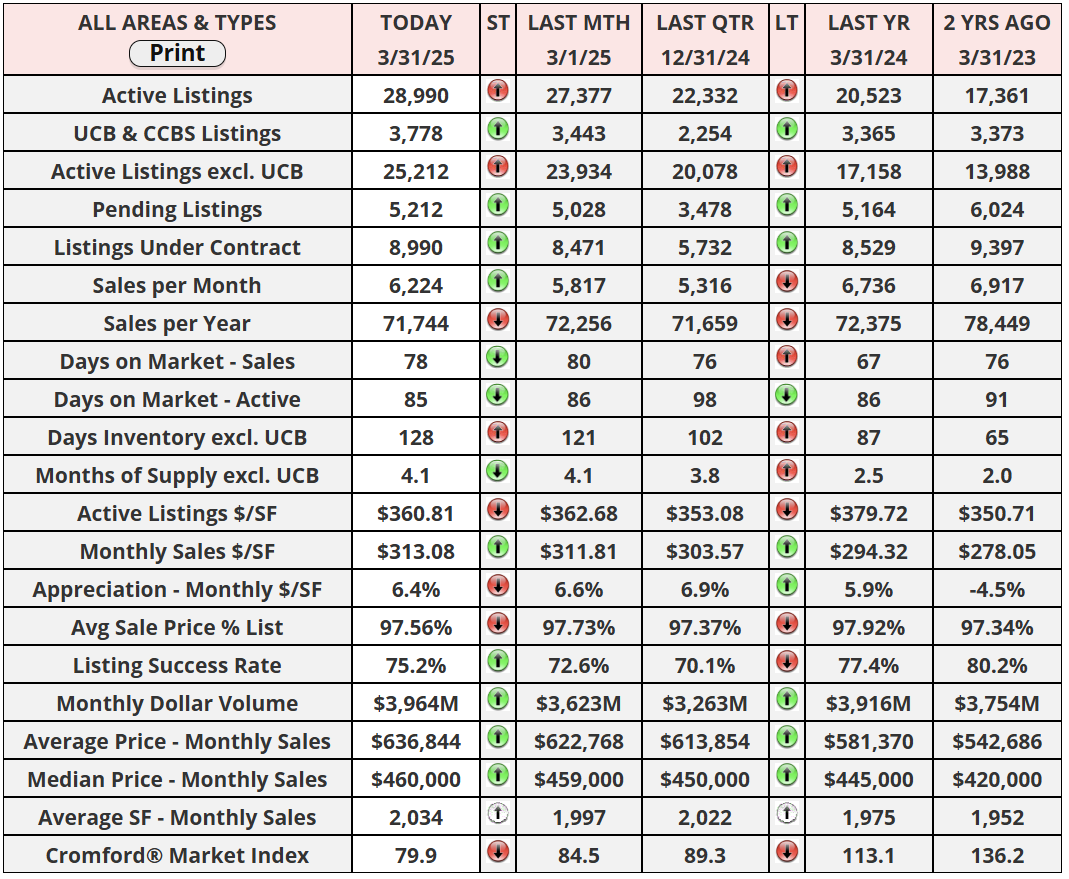

Overall, the average CMI (Cromford® Market Index) dropped by 2.7% this month, compared to last week's 1.9% decline, indicating the weakening trend continues. While the difference seems minor, the consistent movement signals a meaningful shift. Currently, nine cities remain in seller's market territory, two are balanced, and six have transitioned into buyer's markets. Peoria is the most recent city to join the buyer's market group, with its CMI falling below the 90% threshold.

A historic milestone was reached as the Cromford® Supply Index hit 100 for the first time since May 29, 2011, confirming that the long-standing housing shortage has ended. However, this increase in supply is not due to a surge in listings alone but is more heavily influenced by a significant drop in demand. The Cromford® Demand Index sits about 19% below normal, meaning there are roughly 24% more homes for sale than needed to meet current buyer activity. This is particularly concerning given that we are in the midst of what should be the peak buying season.

From a negotiation standpoint, it's a good time to be a buyer, but confidence is fragile. While closed sale prices have held up well, largely thanks to strength at the high end of the market, leading indicators such as active listings and homes under contract are showing weakness. There is growing concern about a potential negative feedback loop, where falling prices discourage buyers further, leading to even weaker demand. Lower mortgage rates could provide some relief, but given persistent inflation, such a shift seems unlikely in the near term. For now, caution and awareness are key as market conditions continue to evolve.

"Develop success from failures. Discouragement and failure are two of the surest stepping stones to success"

— Dale Carnegie

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "