Why Mortgage Rates Rose After the Fed Cut Rates Again

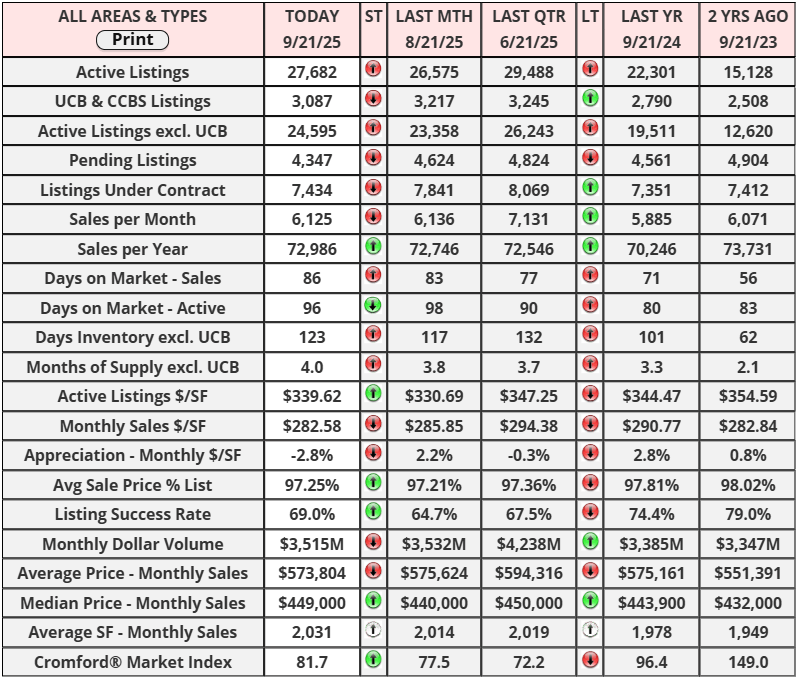

Over the past several months, the Federal Reserve has dominated housing market discussions. As September approached, many grew increasingly confident that the Fed would lower the federal base rate and with it, assumed mortgage rates would drop. But this assumption overlooked a key lesson from September 2024. That month, despite the Fed lowering the base rate, mortgage rates actually jumped and remained elevated through the end of the year. The reality is that mortgage rates and the Fed’s base rate don’t move in lockstep, and predicting their behavior is far from straightforward.

Much of the optimism around lower mortgage rates was priced into the market before the Fed’s decision was officially announced. Lenders had been hopeful and responded by lowering rates ahead of time. However, once the rate cut became official, the longer-term outlook seemed less favorable than expected, prompting rates to rise again. Today, average mortgage interest rates are roughly 25 basis points higher than the lows seen in early September. Borrowers who locked in rates before September 17 got a favorable deal, while those who waited may now be facing higher costs.

The upside is that even with the recent increase, today’s mortgage rates remain lower than they were during 11 of the last 12 months. That relative affordability should help sustain buyer demand, especially compared to last year, although the increase may be modest. Buyers remain active and engaged, particularly those who are sensitive to small shifts in interest rates and looking to capitalize before potential future increases.

On the supply side, the story is changing as well. New listings are arriving steadily, reversing the previous downward trend in inventory. The Cromford® Supply Index, which had been falling, has now flattened and is beginning to turn upward. This trend is expected to continue for at least the next two months, providing more choices for buyers and perhaps adding a bit more balance to an evolving market landscape.

"The best way to predict your future is to create it."

– Abraham Lincoln

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "