Mortgage Rates Dip to 6.52% as Phoenix Demand Begins to Rebound

Mortgage rates have quietly shifted in favor of buyers. The typical 30-year fixed rate now sits at 6.52%, a welcome drop from the 7%+ levels we saw earlier this year. While this rate may not feel "low" by recent standards, it’s important to zoom out: the long-term median since 1971 is 7.3%. In fact, for more than two decades between 1971 and 1993, rates never dipped below 7%, and from 1974 to 1991, they hovered closer to 9–10% or more. In that context, today’s rates are actually quite attractive.

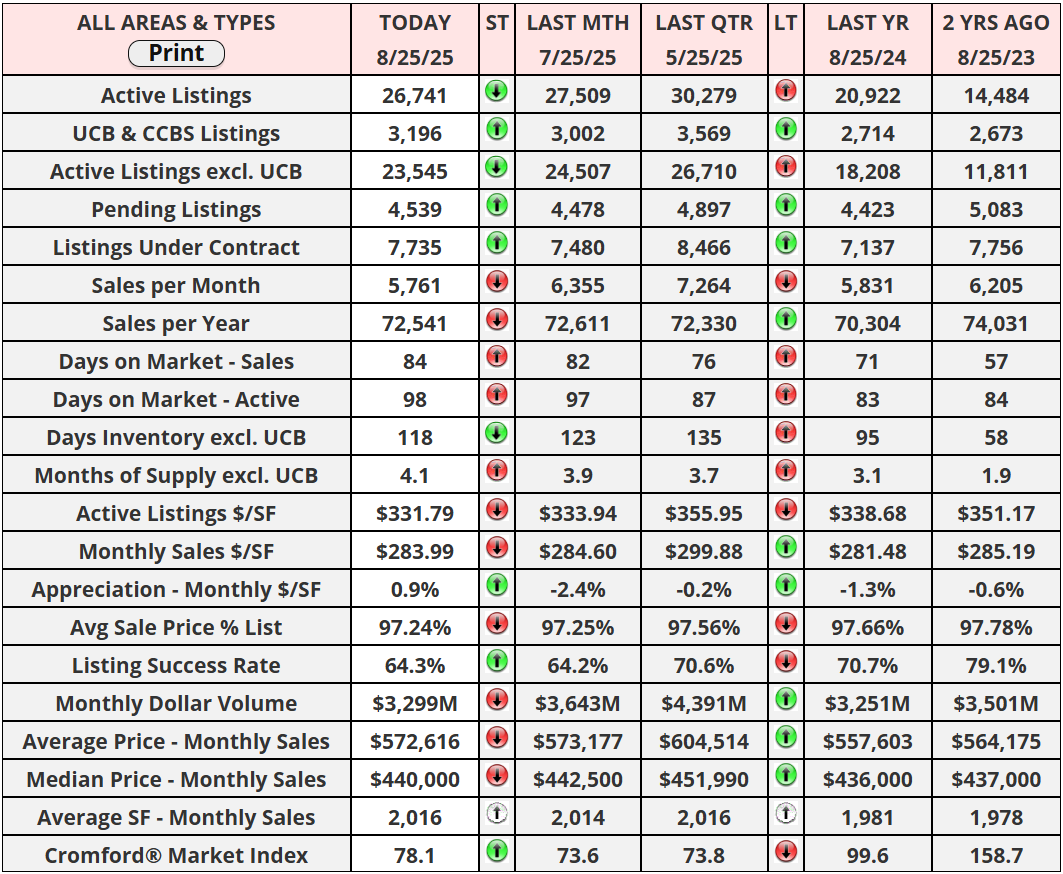

With borrowing costs easing, a natural question arises are we seeing a rebound in buyer activity? The answer appears to be yes. The Cromford® Demand Index hit a low of 75.8 on August 4 but has since crept up to 76.8. Although still well below normal demand levels (100 is considered balanced), this uptick marks a meaningful shift, especially as the pace of improvement is starting to accelerate.

At the same time, supply is quietly thinning out. Many sellers have pulled their listings off the market, causing inventory to decline. When falling supply meets rising demand, conditions become more favorable for the sellers still in the game. This shift is already showing up in the numbers. Listings under contract have climbed 6.9% over the last 7 weeks, pushing activity nearly in line with 2023.

The year-over-year gap between 2024 and 2025 continues to widen in favor of the current market. While we’re not back to pre-pandemic frenzy levels, this quiet momentum is worth paying attention to. If rates stay in the mid-6s and inventory remains tight, sellers could see stronger tailwinds heading into fall.

"The most effective way to do it, is to do it."

-Amelia Earhart

Have a great week, everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "