Phoenix Price Cuts Surge — But Don’t Mistake It for a Crash

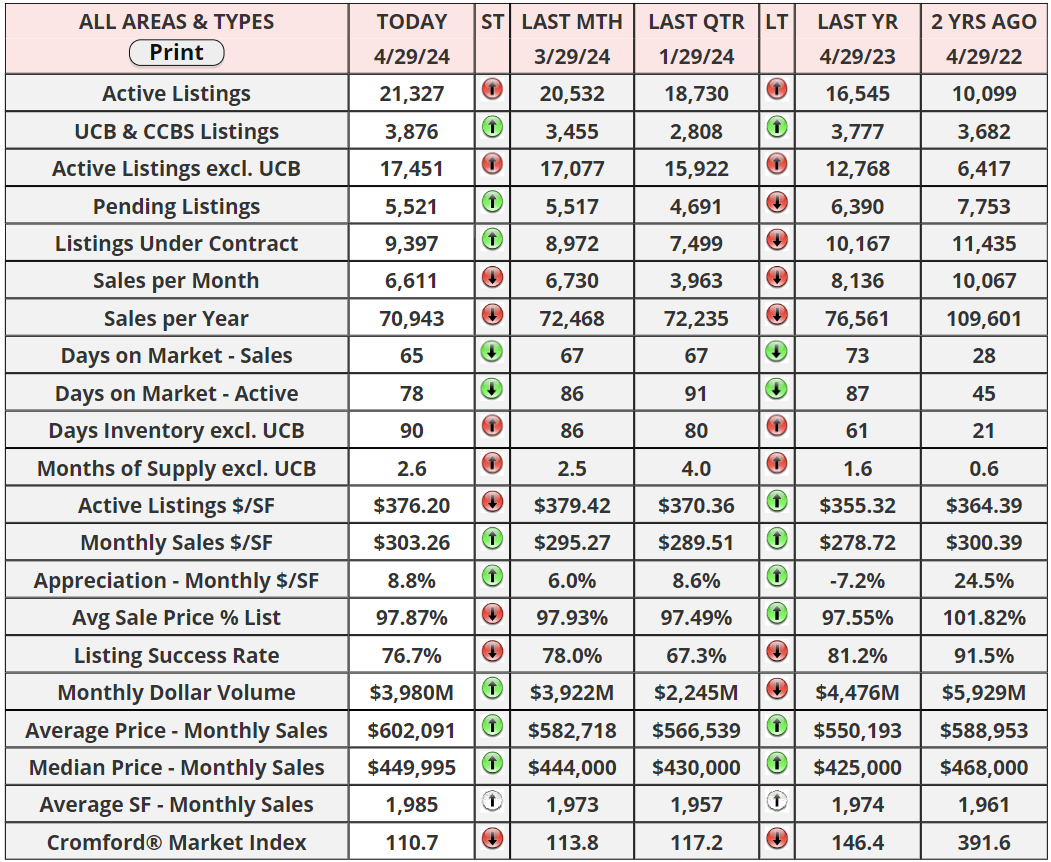

The real estate market has recently witnessed a substantial number of price reductions, with almost 9,000 price cuts observed over the last four weeks. This is a rate not seen since January of the previous year. This sudden surge in price reductions is reminiscent of the period between June and December 2022, when iBuyers aggressively lowered prices across their extensive inventories. However, even excluding that unique phase, the current number of price cuts is one of the highest since 2020, highlighting a significant trend in the market dynamics.

A deeper analysis reveals that a staggering 56% of active listings have undergone price reductions in the last month. This widespread phenomenon indicates a broader market adjustment rather than isolated incidents. Notably, this trend is not confined to lower or mid-range homes; it also significantly impacts the luxury segment. Homes priced over $3 million, though fewer in number, are experiencing more frequent price cuts than usual. This suggests a shift in buyer behavior and market expectations, even among higher-end properties.

Focusing specifically on the high-end market, the data shows distinct patterns in price adjustments. Out of the 668 homes listed above $3 million, 184 have seen price reductions in the past four weeks, which represents 27.5% of such listings. This rate is particularly pronounced in the $3 million to $5 million range, where 32.4% of homes have experienced cuts. The pattern changes slightly in the ultra-luxury segment, with homes priced over $5 million seeing price reductions at a lower rate of 22%. These statistics not only illustrate the extent of the current price adjustments but also indicate varying levels of buyer resistance across different price tiers.

The ongoing trend of price cuts, especially in the higher echelons of the market, suggests a cooling period where sellers are adjusting to align with reduced buyer demand and changing economic conditions. Homes in the upper price brackets typically stay on the market longer, and their price adjustments are spread out over several months. This slower pace of sales and extended market exposure necessitates more significant price adjustments to attract buyers. Overall, these developments could signal a shift towards a buyer's market, particularly in the luxury segment, where adjustments tend to be more pronounced due to the higher stakes involved.

Proper education from agents to their clients who understand the numbers can easily show, that this price cutting is not the direct result of pricing dropping but from mortgage rates and demand fall off. Inventory is still at a low. What this means sellers shouldn't be rushing to slash pricing because these rates are not affecting too much unless you're cutting a tremendous amount, instead sellers should be going in with the understanding that it will just take longer to sell. And instead of cutting, seller concession should be the answer first not just cut cut cut!

“Never confuse a single defeat with a final defeat.”

— F. Scott Fitzgerald

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "