December Jobs Report Shows Mixed Signals: Labor Market Cools as Home Prices Hold Steady

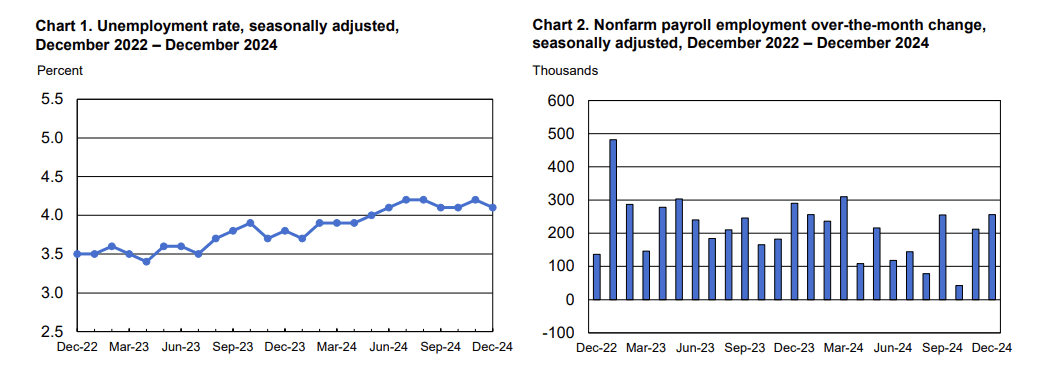

December’s headline job growth figure, released on Friday, suggests a robust labor market, though it is subject to revision in subsequent reports. The initial data showed strength in multiple areas, including increases in both full-time and part-time employment after declines in November. However, the report revealed some concerning trends, like the average duration of unemployment climbing to 23.7 weeks—the highest since April 2022! Additionally, Friday’s release of ADP’s Employment Report showed weaker-than-expected private sector job growth, with December adding only 122,000 jobs, marking the lowest since August. November’s job growth figure remained unrevised, keeping the spotlight on a cooling trend in the labor market.

The bulk of December’s hiring came from the services sector and large businesses, as reported on Friday, with small businesses finally showing slight gains after previous losses. That’s an improvement! Wage growth moderated for both job-changers and job-stayers, with stayers experiencing the slowest wage growth since July 2021. Meanwhile, Friday’s Job Openings and Labor Turnover Survey (JOLTS) report highlighted a rise in job openings to 8.098 million, surpassing forecasts. However, a drop in both the hiring rate and the quit rate reflected underlying labor market weakness. Overcounting of remote job postings and a significant drop in the job openings to unemployment ratio further emphasized a labor market that’s cooling off.

Friday’s unemployment claims data painted a mixed picture! Initial Jobless Claims fell during the holiday period while Continuing Claims rose to 1.867 million. This signals a persistent slowdown in hiring, with Continuing Claims staying above 1.8 million for over 30 weeks. Seasonal factors, like holiday travel, may have skewed the numbers, but the broader trend points to longer periods of unemployment as job opportunities become harder to find. On a brighter note, CoreLogic’s Home Price Index, also released Friday, showed that home prices were flat in November, with a forecasted annual appreciation of 3.8%—a big jump from previous expectations! This highlights real estate’s ongoing strength as a wealth-building tool.

Looking ahead, several major economic indicators are on deck this week, including inflation data and housing reports. These updates will be crucial as they influence the Federal Reserve’s next moves on interest rates. Following Friday’s strong job data, Mortgage Bonds faced downward pressure, testing key support levels and signaling potential shifts in financial markets. As labor market trends and housing data evolve, it’s clear that keeping an eye on these numbers will be key to understanding what’s next for the economy!

"I believe there's an inner power that makes winners or losers." And the winners are the ones who really listen to the truth of their hearts."

— Sylvester Stallone

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "