Mortgage Rates Drop Sharply — But Homebuying Still Stalls. Will 5% Be the Magic Number?

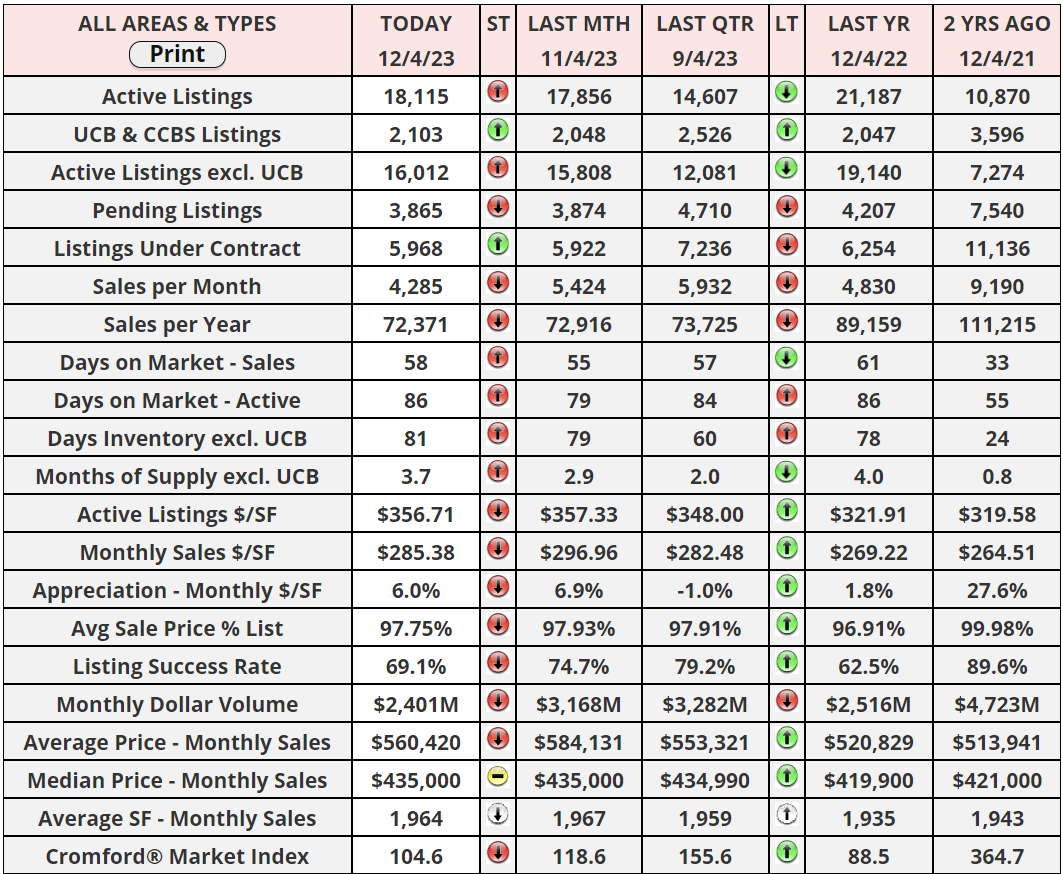

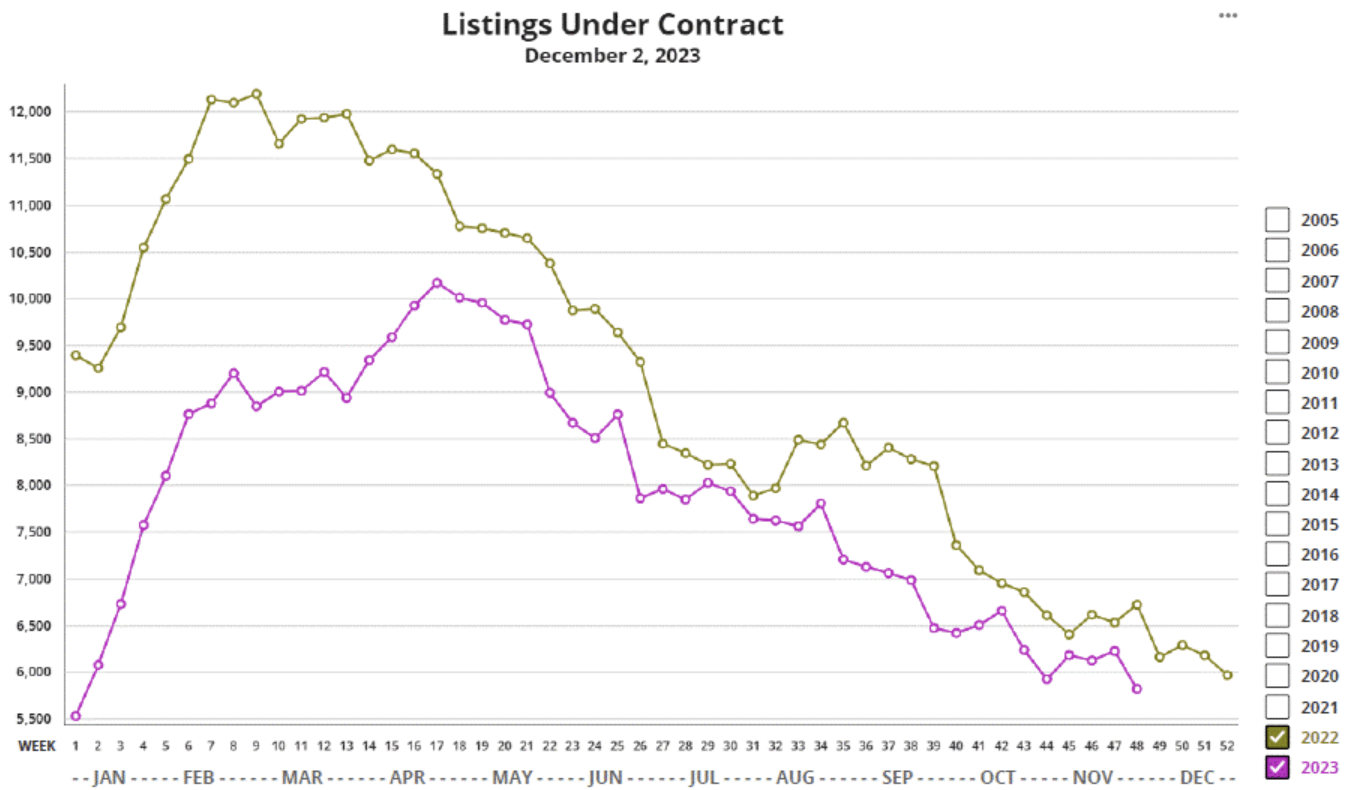

The recent trend of declining mortgage rates in the U.S. housing market, specifically the 30-year fixed mortgage rate, has drawn significant attention. This rate fell notably from 7.92% on October 30 to 7.09% by December 1, a substantial decrease over a short period. Typically, lower mortgage rates are expected to boost home buying, as they reduce long-term borrowing costs, potentially attracting more buyers. However, contrary to these expectations, the anticipated surge in home purchasing has not materialized. While there's been an increase in mortgage applications, this hasn't led to a corresponding rise in home-buying contracts. Data from the Arizona Regional Multiple Listing Service (ARMLS) reinforces this observation, with the number of listings under contract as of December 2 being 5,817, disappointingly lower than the 2022 figures.

The discrepancy between the drop in mortgage rates and the stagnation in home purchasing contracts suggests that other factors are influencing buyer behavior. Economic uncertainties, such as inflation and job security concerns, maybe make potential buyers hesitant. Additionally, the overall affordability of homes, including listing prices, could still be out of reach for many. The current housing market inventory might also not align with the preferences or needs of prospective buyers. These elements highlight the complex nature of the housing market, where various factors interplay to shape trends and buyer decisions.

The future trajectory of the housing market in light of these developments remains uncertain. If mortgage rates continue to decline or stabilize at lower levels, and if other economic conditions improve, there might be an eventual uptick in home-buying activity. Conversely, if mortgage rates rise again or if other deterrents persist, the market may continue to experience a lull in purchasing contracts. This situation underscores the importance of considering a range of economic and personal factors when analyzing the real estate market, beyond just the cost of borrowing. As such, real estate stakeholders must remain vigilant and adaptable to the changing trends and consumer preferences in this dynamic sector.

I am still firm on my opinion even with economic uncertainties happening, if mortgage rates drop to around 5% our market here will actually experience another boom. I believe that is the magic number to entice homeowners to sell and move up, unlocking a bunch of inventory that is just waiting in the shadows. And we have enough pent-up demand unfortunately that it will soak up any surge in supply at that mortgage rate.

"Things do not happen. Things are made to happen."

-John F. Kennedy

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "