New Builds Overtake Resales as Buyer Preferences Shift in 2024

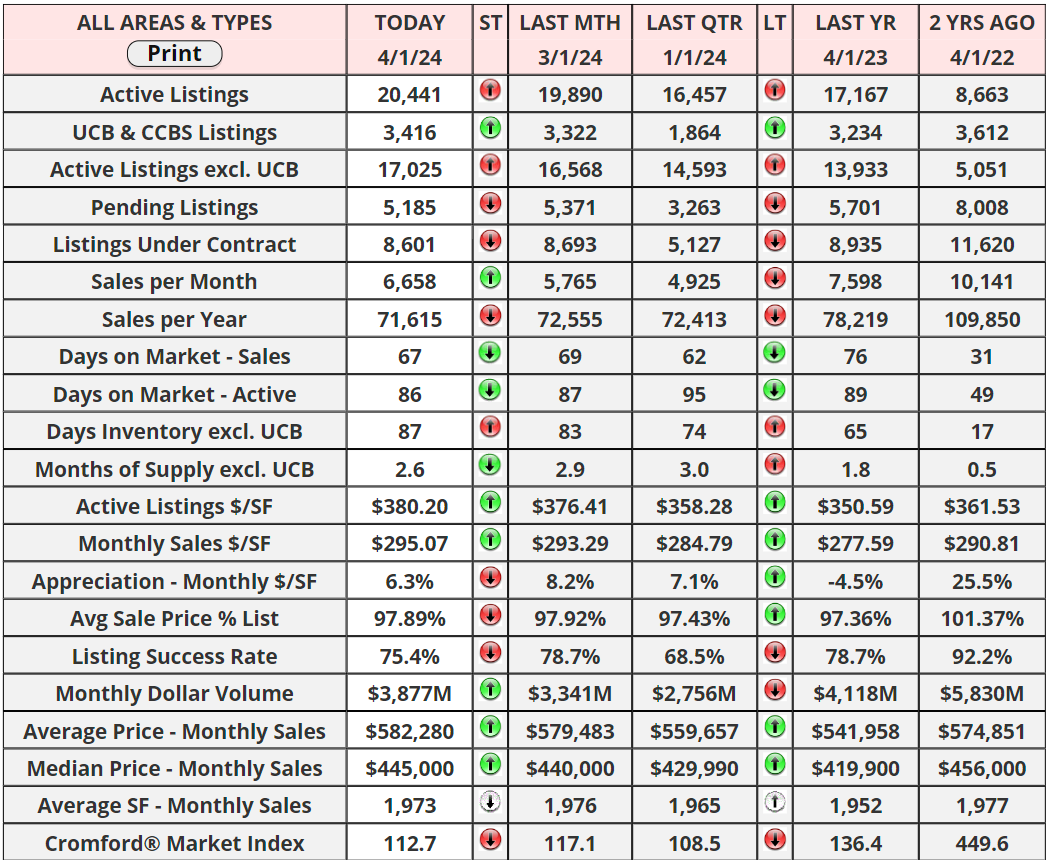

The housing market, particularly in the resale segment, has experienced a noticeable decrease in transaction volumes over several months, highlighting a trend of stagnation within this part of the industry. Conversely, the market for new homes tells a strikingly different story, one of growth and increasing demand. During the initial months of 2024, builders in Maricopa and Pinal counties reported closing on 3,351 new homes, marking the highest figure since 2006 and representing a nearly 16% increase from the previous year. This surge in new home sales is significantly drawing potential buyers away from the resale market, with the impact felt more profoundly in Pinal County, where the increase in closings reached an impressive 32% over the previous year.

In Maricopa County alone, the rise in new home closings surpassed 10%, while the resale market saw a slight decline of 0.4% in the same timeframe. This shift in market dynamics suggests a growing preference for new construction, which, despite traditionally being more costly, now presents a competitive edge in pricing. Surprisingly, the average price per square foot for new homes in February 2024 was $269.75 across both counties, considerably lower than the resale average of $298.55. This competitive pricing can largely be attributed to the strategic placement of new developments in more affordable locations further from the urban center, where land costs are lower, thus offering greater value to homebuyers.

The principle of "location, location, location" remains paramount in real estate, underscoring the immutable value of a property's geographical placement. With the rise of remote work, the location has taken on new dimensions of significance, allowing individuals to save substantially by choosing homes in less central areas without compromising on the quality of life. This evolving dynamic suggests that the willingness to live farther from city centers can yield significant financial benefits, a trend bolstered by the current pricing strategies in the new home segment.

Data from the Cromford® Public section, which draws on public records rather than MLS data, provides a comprehensive and slightly more accurate analysis of these market trends, despite being somewhat delayed. This approach is essential for new home sales analysis, as a significant portion of these transactions do not go through the MLS. Thus, relying on public records offers a more complete picture of the market, underscoring the importance of accuracy and timeliness in real estate data. As the market continues to evolve, such detailed insights are invaluable for understanding the shifting landscapes of new and resale home sales.

With rates hovering around 7%, New home builders will continue to have a leg up on resale listings due to the high-profit margins, they can give back a tremendous amount of seller credits back to buyers. Something worth monitoring if this remains true if rates start to drop again.

"One reason people resist change is because they focus on what they have to give up, instead of what they have to gain." - Rick Godwin

Have a great week everyone!

Recent Posts

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "